Another day, another mailing from John Lewis Finance politely asking why I haven’t got around to applying for their new Partnership credit card.

But this isn’t a regular credit card recruitment mailing of the kind that MBNA and Capital One used to carpet-bomb the nation with at the end of the last century.

The thing is, I’m already a “loyal” John Lewis credit card holder (though I won’t be for much longer.)

We’ve actually had a JLP credit card for nearly 20 years, and never had an issue with it.

It’s not cost us anything to hold. They regularly send us vouchers to spend in John Lewis or Waitrose. Customer service has been (reasonably) frictionless.

So what’s going on? Why ask me to re-apply for something I already have?

***

Earlier in 2022 John Lewis announced it was ceasing its own-label credit card provider relationship with HSBC and switching its provider to a specialist company called New Day:

John Lewis relaunches Partnership reward credit card with New Day – Which? News

There will have been genuine business reasons for this – perhaps HSBC are reining back on providing own-label credit cards. Or perhaps New Day have offered JLP a much better commercial offer to switch provider.

Whatever the reason, John Lewis’ decision to switch credit card provider will have come with a consequent challenge, which seems to be this:

Existing cardholders’ credit agreements actually seem to be with a company called “John Lewis Financial Services” which – despite the name – seems to be wholly owned and run on John Lewis’ behalf by HSBC.

It may well be that the John Lewis Partnership can’t just migrate a credit agreement from HSBC to New Day without the cardholder’s express permission.

And doubtless New Day will have its own credit scoring thresholds that the migrating cardholders will have to pass.

And so in order for existing cardholders like me to remain a “loyal” JLP cardholder, we are being asked to complete an online application form to reapply for a credit card we already hold.

No matter how simple John Lewis or New Day make the re-application process, the need for the customer to do anything at all creates friction.

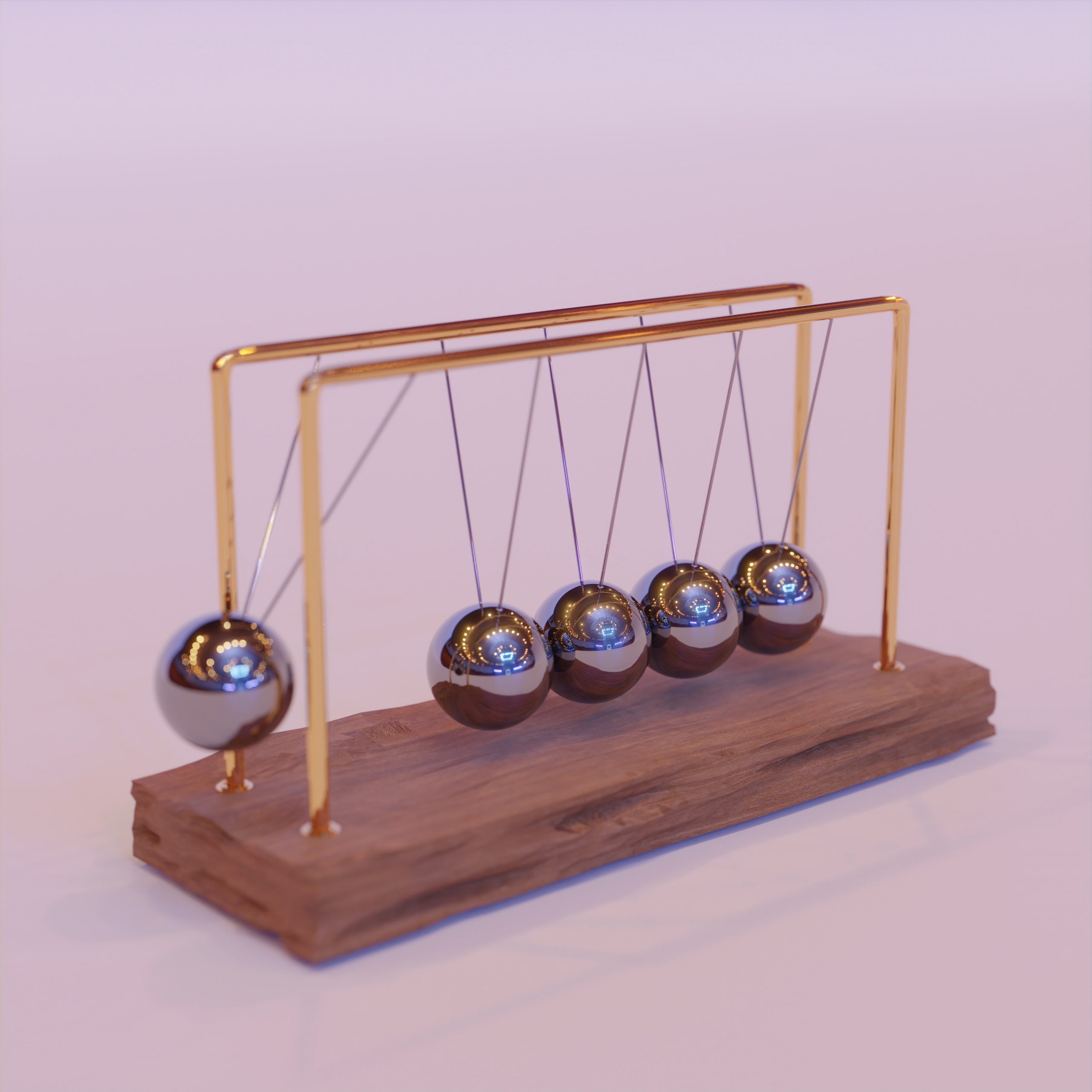

And creating customer friction breaks customer inertia.

Which brings me to the concept of “loyalty”.

***

I’m pretty certain that the data bods at John Lewis reviewing my spending history prior to the migration would have put me squarely in their “JLP Loyalist” pot:

Joint cardholder for nearly 20 years.

Spending patterns indicate it’s been used as a primary credit card.

Regular Waitrose shopper.

Never made a late payment.

Why wouldn’t I migrate to the new card?

The thing is, I’m not especially “loyal” to the JLP card. It’s more that I’m, well … inert.

I’ve never been given a reason not to use my John Lewis card, so I’ve just kept using it out of habit.

But JLP are now forcing me to break that habit and think about whether their card is actually the best card for me.

Doing nothing isn’t an option, because if I do nothing, my existing HSBC-provided card will simply stop working.

And so thus prompted, for the first time in nearly two decades I’ve had to have a quick look around at what other credit cards are on offer.

And of course there are plenty of introductory offers that are way better than the incentive John Lewis are offering up for me to migrate to their new card.

Faced with the unwanted task of having to reapply for my existing credit card, I’ve been nudged out of my inertia and applied for a different one with a much more enticing reason to sign up.

Which set me thinking.

When a business claims it has a “loyal base of x000 customers”, are these customers genuinely “loyal” – or do they simply continue to purchase out of habit?

Are they loyal, or simply inert?

***

Canny marketers looking to maintain revenues in a period of tightening demand may sense an opportunity here, albeit a defensive one.

If most customers aren’t loyal, but simply habitual, then maybe there’s something profitable to be said for re-examining your customer journey to try and eliminate any point that presents grit.

Maybe the question to ask isn’t “How can we reward loyalty?” but “How much easier can we make it for people to buy from us again?”

Example: a jacuzzi company has an IoT device embedded in its filtration system to monitor when the sanitizer is running low so that the sales rep can call the customer before they run out of sanitizer, and offer to send them a replacement. They don’t offer money off for re-ordering as a “loyalty bonus”: they just make timely re-ordering simpler for the customer.

Example: my local garage sends me a reminder email when my car MOT is due, with an API link to a selection of dates that I could book the car in for. I don’t even need to phone to book or ask what time is good for them, I just click the link on the date / time that’s convenient for me (and that their booking system tells me is available). Again, they don’t offer me money off for repeat bookings – they just make repeat booking as simple as they can.

Are there other examples of companies that engender inertia by making repeat purchase frictionless without having to promise money-off vouchers via a loyalty scheme?

If you know of one, please post it in the comments. (I’m especially interested in B2B examples).

Simon Hayhurst

December 2022

Picture credit: Photo by Sunder Muthukumaran on Unsplash